Is your FinTech Architecture aligned with your organization’s strategic objectives?

In the current business environment, where market dynamics, regulatory demands, and technology are evolving rapidly, keeping finance technology up to date is essential for driving efficiency, staying competitive, and mitigating risks.

Primary Challenges

When finance technology is not up to date, your business organizations face challenges that can hinder your growth, efficiency, and ability to manage risks effectively.

- Reduced Efficiency and Productivity – manual processes which involves legacy systems, slow processing speed due to old dated architecture

- Increased Risk of Security Vulnerabilities – outdated security protocols which is vulnerable to cybercriminals, risk of data breaches increases as legacy systems may not receive regular security updates or patches.

- Non-Compliance with Evolving Regulations – difficulty in meeting new regulations, risk of penalties due to non-compliance.

- Limited Scalability – outdated systems often cannot scale easily to handle increased business demands, lack of flexibility.

- Inability to Innovate and Stay Competitive – modern finance technologies offer features like AI-driven analytics, real-time reporting, outdated systems do not support these innovations.

- High Maintenance Costs – increased operational costs, maintaining legacy systems is often more expensive due to the need for specialized knowledge, manual updates, and troubleshooting.

- Inaccurate Financial Data and Reporting – data Inconsistencies, Financial reporting and forecasting can be delayed or inaccurate due to poor data integration and lack of automation, leading to incorrect decisions.

Modern financial tools infused with AI & Automation could enable our businesses to operate more effectively, make data-driven decisions, maintain compliance, and scale our operations as we grow.

The failure to update finance technology not only puts organizations at a disadvantage but also increases the risk of errors, security breaches, and missed opportunities.

Our next-gen Finance Technology Health Check

At GrowthArc, we’ve designed our next-gen Finance Technology Health Check – a tailored profession service to evaluate your organization’s financial technology architecture, solutions, systems, and tools.

Our Accelerator

| Prebuilt Industry Benchmarking |

| Checklists for FinTech Health Check |

| Technology Audits |

| Gap Analysis Tools |

| Digital Transformation Roadmap |

Our prebuilt industry benchmarking assessment tool allows businesses to quickly assess how their financial systems compare to others in the same industry, highlighting areas where improvements are needed.

Our finance technology health check will help you to identify areas where performance, security, compliance, or innovation could be improved. Our goal is to ensure that the technology supporting financial operations is reliable, efficient, and aligned with your organization’s strategic objectives.

What Our Health Check Includes

Our Finance Technology Health Check is a comprehensive review of your organization’s fintech ecosystem that helps ensure the technology supports the company’s financial goals, remains secure, and can grow and evolve with the business to scale:

- Fintech Ecosystem Assessment – Evaluating whether the current finance systems (e.g., Accounting systems, FP&A budgeting tools, financial reporting system) are performing optimally and meeting business needs, align Fintech Ecosystem roadmap with company’s short-term & long-term goals.

- System Integration Assessment – Validating how well different systems (e.g., CRM, Commerce, Accounting, Budgeting & Forecasting, Treasury, Data Analytic) are seamless integrated and whether data flows accurately between them.

- Automation Opportunities Assessment – Identifying areas where automation could reduce manual tasks, streamline processes, and improve operational efficiency.

- Compliance Assessment – Verifying that the technology complies with relevant financial regulations (e.g., GDPR, PCI DSS, SOX).

- Data Quality and Data Analytics Assessment – Evaluating whether the data used for financial reporting and decision-making is accurate, consistent, and up-to-date. Assessing the effectiveness of analytics tools in providing actionable insights to stakeholders and improving financial forecasting, budgeting, and strategy.

- Scalability and Future-Proofing Assessment – Assessing the ability of the financial technology infrastructure to scale as the organization grows or as financial needs evolve, reviewing whether the organization is leveraging emerging fintech innovations.

How FinTech Innovations Improve Finance KPIs & Metrics

FinTech innovations streamline processes, reduce manual intervention, increase accuracy, enable more data-driven decision-making, and lead to higher overall efficiency in accounting functions.

FinTech Innovations

| Financial Reporting and Accuracy | Cash Flow and Liquidity | Cost Control and Expense | Tax Compliance |

| Report Generation Time Error Rate in Financial Reports Financial Statement Accuracy | Cash Flow Forecasting Accuracy Days Sales Outstanding (DSO) Liquidity Ratios (Current Ratio, Quick Ratio) | Cost-to-Income Ratio Operating Expenses (OpEx) Budget Variance | Tax Filing Accuracy Tax Liability Optimization |

| AI& automation can streamline financial reporting by automating data aggregation and processing, significantly reducing the time required to generate financial statements and reports. | AI can improve cash flow forecasting by analyzing historical data, payment cycles, and economic indicators to predict future cash flows with greater precision. | Automation can reduce operational costs by eliminating manual data entry, reporting, and reconciliation tasks, AI can help identify inefficiencies in spending patterns. | AI-driven tax planning tools can analyze spending patterns, revenue recognition, and other financial variables to optimize tax positions and ensure efficient tax planning. |

| AP & AR Efficiency | Internal Controls and Audit | Financial Forecasting and Performance | Payroll and HR Metrics |

| Accounts Payable Turnover Accounts Receivable Turnover Invoice Processing Time | Audit Accuracy Internal Control Effectiveness Audit Cycle Time | Forecast Accuracy Return on Investment (ROI) Revenue Growth Rate | Payroll Processing Time Cost per Employee |

| Automation in invoice processing helps accelerate the AP/AR process, improving turnover rates. AI and RPA can automatically extract data, validating details, and routing for approval, reducing processing time. | Automation ensures that accounting procedures are followed consistently by enforcing internal controls and tracking transactions in real-time. Automation tools speed up the audit process. | AI and machine learning can improve the accuracy of financial forecasts, AI-powered tools can help finance teams predict revenue growth opportunities by analyzing customer behavior, sales data, and market trends. | Payroll automation tools can handle data entry, benefits administration, and tax calculations, ensuring quick and accurate payroll processing with minimal human intervention. |

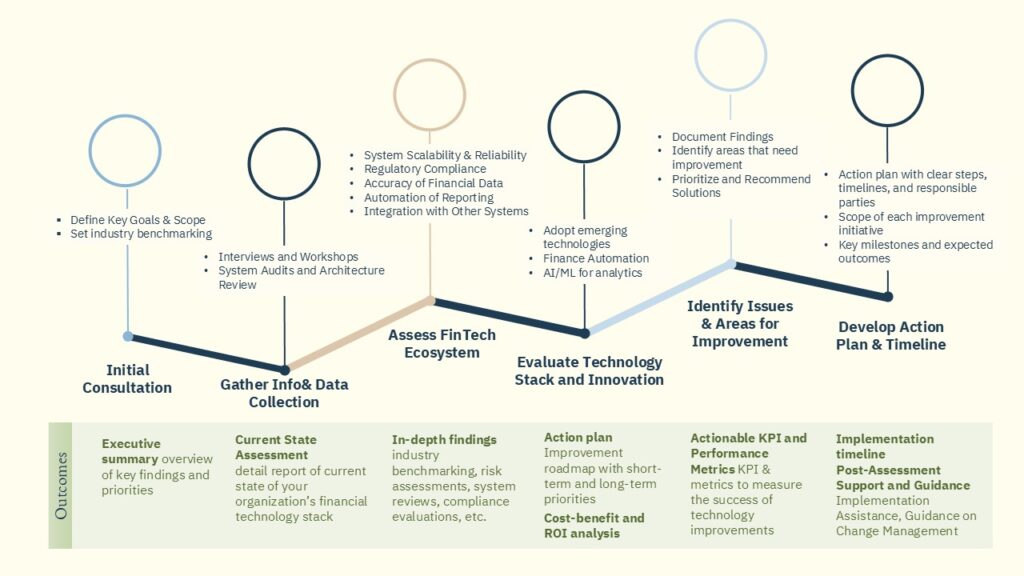

What’s Our Process

At GrowthArc, our Finance Technology Health Check process doesn’t just diagnose challenges—it paves the way for innovation, resilience, and growth. Let us guide your journey to building a scalable, future-ready financial architecture that sets you apart in the competitive FinTech landscape.